Calvert believes that the responsible investment landscape stands at a critical intersection of environmental urgency, technological revolution, and social transformation. While these factors present investment opportunities, they also present challenges that require a nuanced understanding of secular trends and their potential to generate long-term value for investors. At Calvert, we use empirical data and rigorous research as a foundation for our investment process to help identify areas of financial materiality1 that we believe may impact long-term performance.

We expect three themes to shape the investment landscape for the rest of this year and beyond, with each presenting specific challenges and investment opportunities that may be realized through a circular economy:

- Energy

- Affordability

- Data

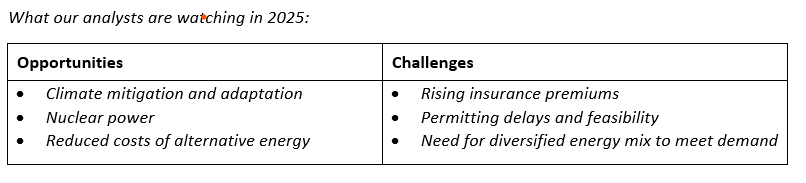

Energy - Systems pulled in different directions

The global energy landscape presents a particularly complex picture. Burning fossil fuels to meet growing global energy demand, driven in large part by AI and computing demands, intensifies near-term physical climate impacts, including damage to property and infrastructure. Real estate owners are forced to allocate additional capital for climate-proofing, while utilities face mounting operational challenges from extreme weather events. Insurance markets, adapting to more frequent and severe climate events, are responding with higher premiums and reduced coverage availability. Since 2017, the cumulative increase of the Guy Carpenter US Property Catastrophe Reinsurance Rate on Line Index is around 94%, even after a moderate decline in January 2025 renewals.2 Banks, too, face potential impairments to loan books as adverse climate trends impact collateral value.

On the energy supply side, nuclear power emerges as a critical pillar for decarbonization. However, the urgency of incremental capacity expansion is tempered by the reality of protracted timelines and budget constraints. While nuclear energy offers unparalleled potential to meet decarbonization targets, the sector must overcome obstacles such as permitting delays, community opposition and technical feasibility. As a marker, the last two nuclear units to come into service in the U.S. took 20 years from announcement to completion at a cost of more than $30 billion combined.3 Small modular reactors (SMRs) may offer a solution to these cost and timing challenge, but it is still too early to tell as most SMRs are still in the design phase.

Meanwhile, the clean energy sector, having stumbled under the weight of high interest rates in recent years, is poised for a revival. Falling rates and economies of scale have reduced costs, reigniting the development of solar and wind projects. Innovations in battery storage are set to complement these projects, improving energy reliability by addressing intermittency issues inherent in renewables.

Heading further into 2025, we see numerous factors pulling the energy system in different directions. The world spent $2.4 trillion4 adding record amounts of clean energy capacity in 2024 and is expected to continue adding capacity in 2025. China, the world's largest oil importer, led that spending charge and is also fast approaching 'peak demand' which will have ramifications for global oil markets. On the other hand, growing energy demand globally, including the expected structural rise from data centers, highlights the need for all available energy sources to power the world economy -- including fossil fuels. Around $1 trillion is spent annually on oil, natural gas and coal supply, which continue to meet 80% of global energy needs.5 Though counterintuitive to climate goals, this reflects the magnitude of the challenge facing the energy transition. Meanwhile, the mining sector has a renewed focus on expanding copper portfolios (including via M&A) to secure what we think is the most important material in the energy transition. Copper is an input into all electrification drivers from EVs to grid expansion to data centers. Plus, copper has a favorable supply/demand outlook - with strong existing industrial demand, growing energy transition demand and a structurally tight supply. For all metals, the rising global social pushback to mining, combined with rising geopolitical tensions, together increase uncertainties in a metals market dominated by China.

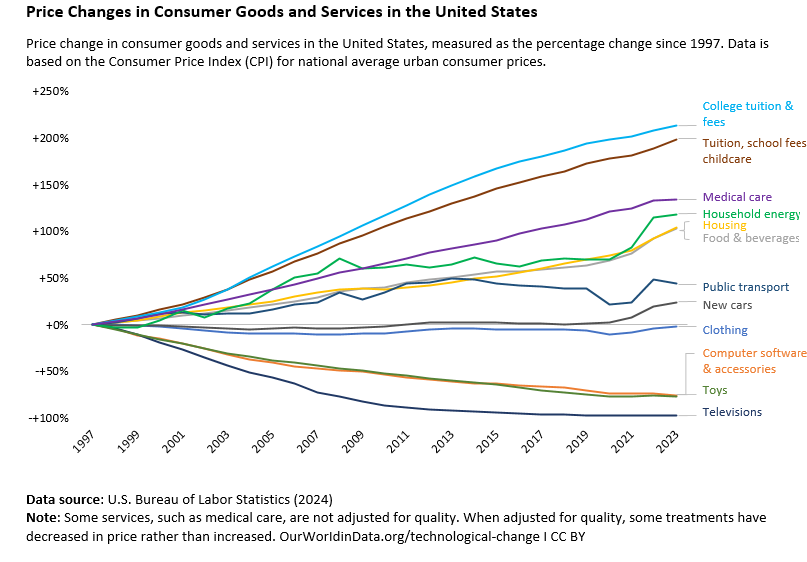

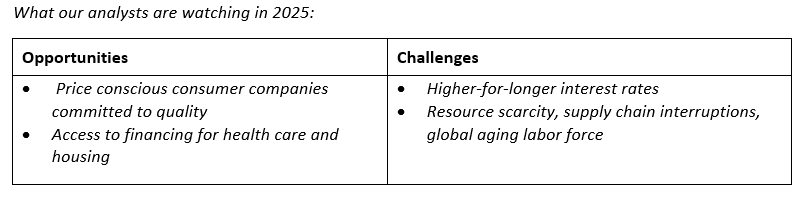

Affordability - Short- and long-term factors

Recent years' rising inflation has exacerbated inequality, hitting younger and lower income groups the hardest, globally.6 The expected higher-for-longer interest rates and sticky inflation will likely continue to stress affordability as well. Going forward, we believe the ability to counteract upward price pressure on basic goods and services that impact both consumers and business, will be crucial.

In certain regions, we have seen affordability quickly transform into financial risk both for companies and households. Geopolitical conflicts have led to price spikes in energy, which has then led to price increases across other value chains. Keeping energy costs low by onboarding additional and alternative forms of energy is critical to affordability. At the same time, as we diversify away from legacy fuels it is imperative that it is done in a way that is inclusive and fair.

For consumer staples and discretionary industries, affordability of goods and services continues to be a challenge. Consumer companies that are price conscious while concurrently maintaining the quality of goods or services are best positioned to retain their customer base in this environment. Additionally, price conscious consumers are likely to stall the shift towards sustainability except in cases where cost parity between sustainable and non-sustainable goods or services has been achieved.7 Further, we believe that expanding people's access to financing for essential services, in particular health care and housing, is going to become more crucial and may call for more policy action from governments.

Intensifying these affordability pressures are long-term factors such as natural resource scarcity, the global aging labor force and climate change; as well as short-to-medium-term factors such as geopolitical tensions and supply chain uncertainty.

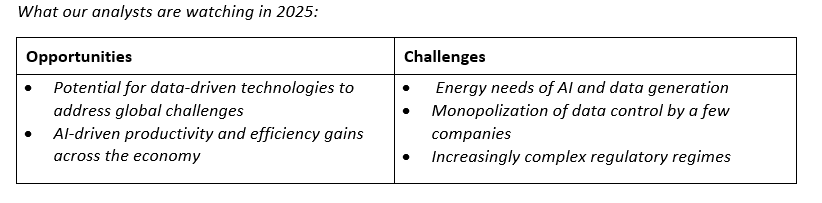

Data - A key solutions facilitator

Data-driven solutions are and will continue to be a key enabler of sustainability. Data has become more critical than ever, serving as the backbone for transformative innovations across artificial intelligence (AI), cybersecurity and health care. The scale of global data generation, projected to exceed 200 zettabytes annually by 2025,8 enables AI to optimize energy use through advanced smart grid systems, streamline supply chains and revolutionize health care with precision diagnostics and personalized treatments.

Data-driven technologies are pivotal in addressing critical global challenges, from combating climate change via enhanced energy management to fostering sustainable practices and resource management. Advancements in AI and the Internet of Things (IoT) further amplify the capabilities of data, enabling smarter, more sustainable systems in sectors like manufacturing, transportation, agriculture, and retail. For instance, AI-enhanced tools are being deployed to predict and mitigate natural disasters, improve biodiversity monitoring and support circular economy initiatives that reduce waste and maximize efficiency.

Yet the benefits of data are not without hurdles. The concentration of data control, evidenced by the 65% global cloud services infrastructure market share of Google, Amazon and Microsoft,9 has prompted increasing regulatory scrutiny worldwide. In Europe, policies like the EU Digital Markets Act aim to curb monopolistic practices and enforce equitable data sharing. Additionally, the U.S. is exploring stricter antitrust measures targeting tech giants. These efforts highlight the global push for fair competition and enhanced privacy protections. Additionally, the environmental footprint of large-scale data processing and storage underscores the urgency for sustainable infrastructure. Leading cloud operators are demonstrating solid commitment to alternative energy solutions and data center infrastructure technologies. However, while AI presents opportunities to mitigate the environmental impact of data centers, the projected energy needed to power that cloud capacity indicate that fossil fuels will need to play a role for some time. Meanwhile, emerging disruptive AI architecture players will also have the potential to alter the tech competitive and energy demand and supply landscape in a profound way. Therefore, the push and pull of AI as a climate solution enabler and obstacle highlights the need for a nuanced approach to research and security selection in this sector.

All Roads Lead to Circularity

The challenges and opportunities presented by these themes -- increasing energy needs, rising costs, data demand -- all point to circularity as an investment solution. It is widely acknowledged that emissions and nature degradation are mispriced externalities and that circular business models can mitigate these externalities and generate economic value.

According to Ellen MacArthur, transitioning to renewable energy alone will only tackle 55% of global greenhouse gas emissions. To avoid the physical and economic risks associated with climate change, additional emissions reductions will need to come from changes to the way we make and use products and food, and how we manage land - this is where the circular economy comes in. For instance, food production accounts for a third of global GHG emissions,10 and by adopting circular economy principles, the food industry could halve its projected greenhouse gas emissions by 2050.11 The economic, health, and environmental benefits of a circular economy for food alone would be worth $2.7 trillion a year by 2050. Continuing to exploit these resources presents financial risks, while business solutions that help preserve ecosystem services can create economic value. A circular model can provide access to this value creation via waste minimization, reusing existing products, energy efficiency and recovering materials. All of which can help to mitigate resource demand and the rising cost of goods.

In Calvert's view, the circular economy model can provide companies with both financial and environmental benefits. The circular economy concept isn't new. However, continuing innovation in technology, data analytics and AI could help solve circular economy complexities and help industries overcome prior implementation challenges at scale.

Bottom line: As we navigate 2025, we are focused on the interplay between energy and affordability and how these challenges could be turned into opportunities, through rigorous data analysis and research, by capitalizing on circularity as a solution. This approach underscores the need for holistic investing guided by a deep understanding of these secular trends and the sectors they impact. We believe 2025 marks not only another cycle in market dynamics, but also a pivotal moment in the transition toward a more sustainable and equitable economic model.

1. Financial materiality helps to identify and assess how sustainability factors impact a company's financial viability or performance or competitive position, giving Calvert a broader and deeper insight into the risk and reward potential of each investment.

2. The Guy Carpenter U.S. Property Rate on Line Index is the proprietary index of US property catastrophe reinsurance Rate-on-Line movements, on brokered excess of loss placements, that has been maintained by Guy Carpenter since 1990. The index covers US property catastrophe renewals. It is updated following January 1 renewals and July 1 renewals reflecting the full year, by calculating the change in ROL year on year across the same renewal basis.

3. U.S. Energy Information Administration, 2024

4. BloombergNEF, 2025

5. BloombergNEF, 2025

6. Federal Reserve Bank of Minneapolis, 2024

7. Long-range EVs are reported to now cost less than the average new car in the US, as per Bloomberg

8. Cybersecurity Ventures, 2024

9. Synergy Research Group, 2023

10. Crippa, M., Solazzo, E., Guizzardi, D. et al. Food systems are responsible for a third of global anthropogenic GHG emissions. Nat Food 2, 198-209 (2021). https://doi.org/10.1038/s43016-021-00225-9

11. Ellen MacArthur, 2022

See below for more important disclosures.

Featured Insights

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.