A portfolio consisting exclusively of underlying Calvert funds provides a more singular and straightforward approach to ESG investing than one consisting of multiple investment managers and approaches. Calvert Responsible Allocation Models offer three advantages for building diversified portfolios while pursuing competitive returns and positive impact.

The Calvert Advantage

Five Guided Model Solutions

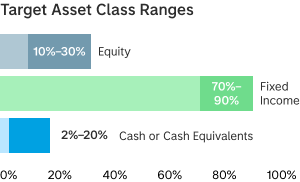

Calvert Responsible Income with Capital Preservation Model

Objective

Income consistent with preservation of capital

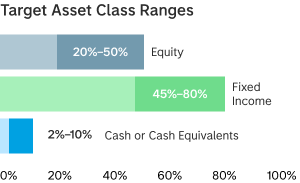

Calvert Responsible Conservative Model

Objective

Current income and capital appreciation consistent with the preservation of capital

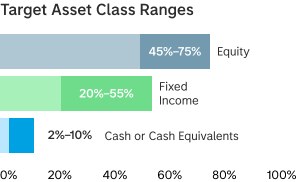

Calvert Responsible Moderate Model

Objective

Long-term capital appreciation and growth of income with current income a secondary objective

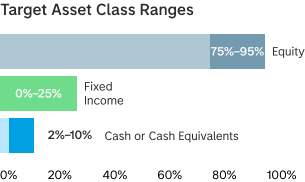

Calvert Responsible Growth Model

Objective

Long-term capital appreciation

Calvert Responsible Aggressive Growth Model

Objective

Long-term capital appreciation

Model holdings are subject to change. Asset allocation, target asset class ranges and percentages are for illustrative purposes only and represent a target allocation for each model.

Learn more about Responsible Allocation Models

Model delivery provided by Calvert Research and Management, a registered investment advisor.

Strategy availability and customization will vary by firm and platform.

About Risk

Investment in mutual funds involves risk, including the possible loss of principal invested. The models are subject to asset allocation risk, which is the chance that selection of, and allocation of assets to, the underlying funds will cause the models to underperform. The Calvert Responsible Allocation Models differ by the percentage invested in equity funds versus fixed-income funds and cash equivalents. Each model shares the principal risks of each underlying fund in which it invests and pays a proportionate share of the operating expenses of those funds. The greater the degree of investments in underlying equity funds, the higher the potential volatility and risk of the responsible allocation model. Thus, Calvert Responsible Growth Model may experience more price fluctuations and involve greater risk than Calvert Responsible Moderate Model, which in turn may experience more price fluctuations and involve more risk than Calvert Responsible Conservative Model. Investing primarily in responsible investments carries the risk that, under certain market conditions, the funds may underperform funds that do not utilize a responsible investment strategy. In evaluating a company, the advisor is dependent upon information and data that may be incomplete, inaccurate or unavailable, which could cause the advisor to incorrectly assess a company’s ESG performance. The models are exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Asset allocation does not ensure a profit and may not protect against a loss.