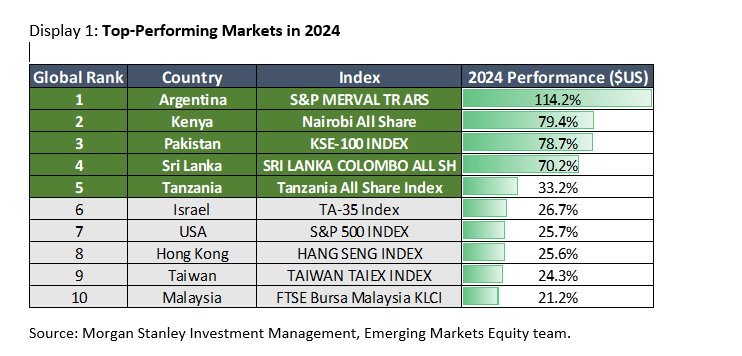

In a year defined by global uncertainty—wars in Eastern Europe and the Middle East, rising U.S.-China tensions, and a shift in U.S. leadership signaling major policy changes—the world's best-performing stock markets weren't to be found among the usual safe havens.

Rather, the five best-performing markets globally in 2024 belonged to the often-overlooked frontier and small emerging markets: Argentina +114% in U.S. dollar terms, Kenya +79%, Pakistan +79%, Sri Lanka +70% and Tanzania +33%.

Each of these markets benefited from significant economic reform and historically low valuations. Going forward, they stand out as uncorrelated opportunities, isolated from global trade wars, and poised for accelerating gross domestic product (GDP) growth driven by recent reforms and strong domestic demand.

Reform, recovery and resurgence

Many frontier markets have experienced severe economic distress over the past year or two. Yet these crises have driven bold reforms, including slashing budget deficits, tightening monetary policy, and loosening currency controls. Countries like Argentina, Egypt, Nigeria, Pakistan, Sri Lanka and Turkey are now on a path to recovery, with a few being top-performing markets last year. We believe these countries, coupled with other high-growth economies like Vietnam and Bangladesh, set the stage for a resurgence in economic growth within the MSCI Frontier Markets index. Their GDP growth is expected to accelerate from 3.4% in 2024 to 4.1% in 2025 while emerging markets are expected to expand by 3.9% and developed markets are estimated to grow by 2.0%.

Escaping China and the tariff trap

Rising geopolitical tensions between Washington and Beijing have led many investors to scale back their exposure to the Chinese market.

While many large emerging markets remain highly exposed to China, many frontier economies, such as Egypt, Bangladesh, Pakistan, Nigeria and Turkey, exhibit much lower sensitivities to Chinese economic data, financial markets or renminbi (Chinese yuan) fluctuations.

These countries, except for Vietnam, are not in the direct crosshairs of trade wars, which helps insulate them from the impacts of tariffs. For example, trade accounts for only a third of GDP in countries like Egypt, Bangladesh, Argentina, Kenya and Pakistan. Frontier markets as a whole account for just 4.4% of global exports compared to 45.2% for emerging markets.

Although investors remain fixated on the tug-of-war between superpowers, the real beneficiaries of U.S. and China tensions are the overlooked middle powers—large, strategically important economies like Indonesia, Vietnam, Pakistan, Egypt, Morocco, Nigeria and Turkey. These countries are becoming battlegrounds for influence and are leveraging superpower rivalries to secure foreign capital for industrial expansion and critical infrastructure development. This influx of strategic investment could transform these middle powers into more resilient economies.

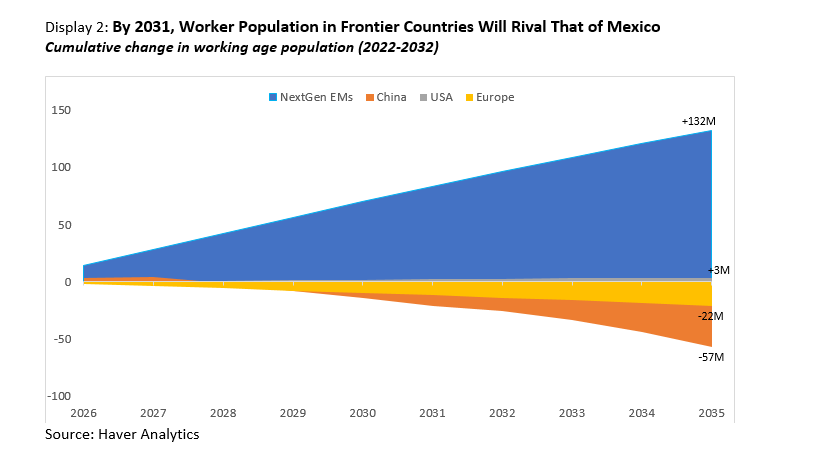

Demographics defying the gray wave

Many frontier markets will also benefit from the continued growth of their human capital. Last year marked the first time in modern history that working age populations declined in developed countries, a trend that will quicken in years ahead. For example, over the next decade, the European Union will lose more than 20 million people from its labor force, according to the United Nations population data.

China faces the same challenge, with an expected loss of nearly 60 million workers over the coming decade. However, over the same period, Vietnam, Indonesia, Philippines, Pakistan, Bangladesh, Egypt and Nigeria—home to a combined population of 1.3 billion—are set to add 132 million people collectively to their workforce, effectively creating another Mexico.

Homegrown heroes

As spending power grows in frontier markets, local brands are steadily capturing market share from global giants. While international brands still dominate aspirational categories, everyday consumer products are increasingly falling into the hands of nimble, homegrown competitors in categories such as groceries in the Middle East, pet food in Southeast Asia and cosmetics in Egypt.

E-commerce and food delivery platforms have leveled the playing field, eliminating the need for huge marketing budgets and massive distribution networks to stock retail shelf space.

For investors, this presents a potentially powerful, long-term opportunity to tap into emerging local brands that best understand their markets.

Bottom line: Frontier and small emerging markets are leveraging their youthful populations, rising foreign investment and relatively insulated domestic demand to ignite their economic growth on the back of recent reforms. Trading at historically low valuations, these markets offer global investors access to growth and diversification in ways that major markets cannot. For those willing to look, opportunities are often hiding in plain sight.

Risk considerations: Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. The risks of investing in emerging market countries are greater than the risks generally associated with investments in foreign developed countries.

See below for more important disclosures.

Featured Insights

IMPORTANT DISCLOSURES

The views expressed in these posts are those of the author are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Eaton Vance disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Eaton Vance are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness.

This material has been issued by any one or more of the following entities:

EMEA: This material is for Professional Clients/Accredited Investors only.

In the EU, MSIM and Eaton Vance materials are issued by MSIM Fund Management (Ireland) Limited (“FMIL”). FMIL is regulated by the Central Bank of Ireland and is incorporated in Ireland as a private company limited by shares with company registration number 616661 and has its registered address at 24-26 City Quay, Dublin 2 , DO2 NY19, Ireland.

Outside the EU, MSIM materials are issued by Morgan Stanley Investment Management Limited (MSIM Ltd) is authorised and regulated by the Financial Conduct Authority. Registered in England. Registered No. 1981121. Registered Office: 25 Cabot Square, Canary Wharf, London E14 4QA.

In Switzerland, MSIM materials are issued by Morgan Stanley & Co. International plc, London (Zurich Branch) Authorised and regulated by the Eidgenössische Finanzmarktaufsicht ("FINMA"). Registered Office: Beethovenstrasse 33, 8002 Zurich, Switzerland.

Outside the US and EU, Eaton Vance materials are issued by Eaton Vance Management (International) Limited (“EVMI”) 125 Old Broad Street, London, EC2N 1AR, UK, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority.

Italy: MSIM FMIL (Milan Branch), (Sede Secondaria di Milano) Palazzo Serbelloni Corso Venezia, 16 20121 Milano, Italy. The Netherlands: MSIM FMIL (Amsterdam Branch), Rembrandt Tower, 11th Floor Amstelplein 1 1096HA, Netherlands. France: MSIM FMIL (Paris Branch), 61 rue de Monceau 75008 Paris, France. Spain: MSIM FMIL (Madrid Branch), Calle Serrano 55, 28006, Madrid, Spain.

NOT FDIC INSURED | OFFER NO BANK GUARANTEE | MAY LOSE VALUE | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A DEPOSIT

Hong Kong: This material is disseminated by Morgan Stanley Asia Limited for use in Hong Kong and shall only be made available to “professional investors” as defined under the Securities and Futures Ordinance of Hong Kong (Cap 571). The contents of this material have not been reviewed nor approved by any regulatory authority including the Securities and Futures Commission in Hong Kong. Accordingly, save where an exemption is available under the relevant law, this material shall not be issued, circulated, distributed, directed at, or made available to, the public in Hong Kong. Singapore: This material is disseminated by Morgan Stanley Investment Management Company and should not be considered to be the subject of an invitation for subscription or purchase, whether directly or indirectly, to the public or any member of the public in Singapore other than (i) to an institutional investor under section 304 of the Securities and Futures Act, Chapter 289 of Singapore (“SFA”); (ii) to a “relevant person” (which includes an accredited investor) pursuant to section 305 of the SFA, and such distribution is in accordance with the conditions specified in section 305 of the SFA; or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA. This publication has not been reviewed by the Monetary Authority of Singapore.

Australia: This material is disseminated in Australia by Morgan Stanley Investment Management (Australia) Pty Limited ACN: 122040037, AFSL No. 314182, which accept responsibility for its contents. This publication, and any access to it, is intended only for “wholesale clients” within the meaning of the Australian Corporations Act. Calvert Research and Management, ARBN 635 157 434 is regulated by the U.S. Securities and Exchange Commission under U.S. laws which differ from Australian laws. Calvert Research and Management is exempt from the requirement to hold an Australian financial services licence in accordance with class order 03/1100 in respect of the provision of financial services to wholesale clients in Australia.

Japan: For professional investors, this document is circulated or distributed for informational purposes only. For those who are not professional investors, this document is provided in relation to Morgan Stanley Investment Management (Japan) Co., Ltd. (“MSIMJ”)’s business with respect to discretionary investment management agreements (“IMA”) and investment advisory agreements (“IAA This is not for the purpose of a recommendation or solicitation of transactions or offers any particular financial instruments. Under an IMA, with respect to management of assets of a client, the client prescribes basic management policies in advance and commissions MSIMJ to make all investment decisions based on an analysis of the value, etc. of the securities, and MSIMJ accepts such commission. The client shall delegate to MSIMJ the authorities necessary for making investment. MSIMJ exercises the delegated authorities based on investment decisions of MSIMJ, and the client shall not make individual instructions. All investment profits and losses belong to the clients; principal is not guaranteed. Please consider the investment objectives and nature of risks before investing. As an investment advisory fee for an IAA or an IMA, the amount of assets subject to the contract multiplied by a certain rate (the upper limit is 2.16% per annum (including tax)) shall be incurred in proportion to the contract period. For some strategies, a contingency fee may be incurred in addition to the fee mentioned above. Indirect charges also may be incurred, such as brokerage commissions for incorporated securities. Since these charges and expenses are different depending on a contract and other factors, MSIMJ cannot present the rates, upper limits, etc. in advance. All clients should read the Documents Provided Prior to the Conclusion of a Contract carefully before executing an agreement. This document is disseminated in Japan by MSIMJ, Registered No. 410 (Director of Kanto Local Finance Bureau (Financial Instruments Firms)), Membership: the Japan Securities Dealers Association, The Investment Trusts Association, Japan, the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association.